- They prefer Swiss refineries affiliated to the London Bullion Market Association (LBMA)

- Rand Refinery in South Africa is the only African refinery to be a member of the LBMA

- Refineries exist in Ghana, Mali, Rwanda, Zimbabwe

- The transitional government wants to create a refinery in Burkina Faso

The transition led by Captain Ibrahim Traoré has expressed its desire to set up a gold refinery in Burkina Faso. Indeed, at the end of the Council of Ministers on 7 December 2022, the Minister of Mines, Simon Pierre Boussim, declared that he had received instructions to set up a refinery in Burkina Faso in order to know the production volumes and gold content. The President of the Transition confirmed this information during an interview broadcast on the Radio and Television of Burkina on Friday 3 February 2023.

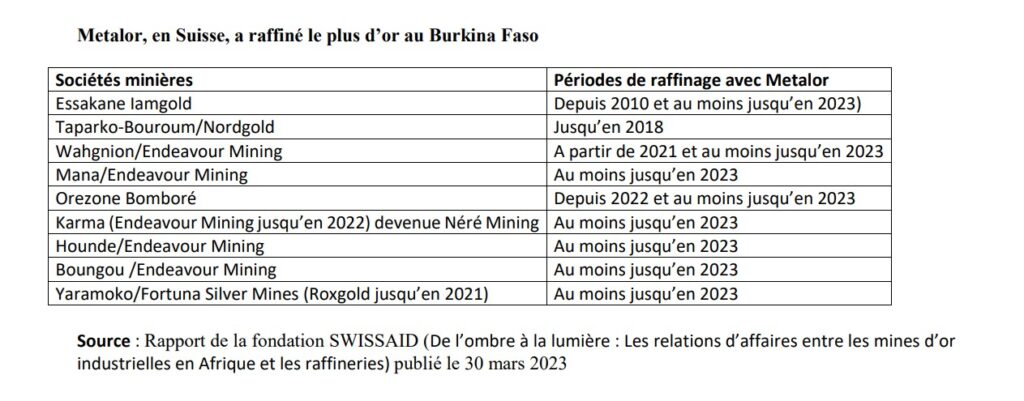

As a reminder, Burkina Faso produced 62.74 tonnes of gold in 2020. This production increased significantly in 2021 to 66.858 tonnes before falling to 57.675 tonnes in 2022. All of this production is exported to 03 refineries in Switzerland, including Metalor, MKS PAMP / MMTC-PAMP and Argor-Heraeus, according to SWISSAID in a report published in March 2023.

For the EITI 2020 report, in addition to Switzerland, companies operating in Burkina Faso have exported their gold to India. Other sources point to Dubai as a possible destination for gold from Nordgold’s mines.

However, there are refineries in West Africa, including one in Ghana and 02 in Mali. All are privately owned. Other refineries are located in South Africa, Rwanda, Zimbabwe, etc. Pending the establishment of the Burkinabe refinery and the setting of a production quota for the mines established for this refinery, it can be seen that despite the presence of refineries on the continent, the industrial mines prefer Switzerland.

The main reason for this preference is the affiliation of Swiss refineries with the London Bullion Market Association (LBMA). Established in 1987, the LBMA is the association for the gold trade. It has over one and a half hundred members, including refiners.

The LBMA is also a precious metals exchange that has established quality standards, norms that ensure transparency and stakeholder confidence. In order to be a member, the refinery must meet certain criteria, including refining at least 10 tonnes of gold per year.

Rand Refinery, based in South Africa, is the only African refinery to be a member of the LBMA.

Listed mining companies prefer to refine their production in LBMA member refineries to benefit from the LBMA standards. But why don’t they go to Rand Refinery?

SWISSAID investigated the refineries that receive gold from Africa in general and Burkina Faso in particular over the period 2015-2023. The foundation collected information between January 2021 and February 2023 through documentary research which was complemented by verification with the mining companies concerned.

The investigation involved several LBMA-certified refineries apart from one refinery in Zimbabwe and some Emirati and Chinese refineries.

The world’s largest refineries

Metalor: Founded in 1852, Metalor is an international group headquartered in Marin, in the canton of Neuchâtel, Switzerland. It is owned by Tanaka Precious Metals and has 17 subsidiaries including five refineries. All of them are LBMA certified and are located in China (Suzhou), the United States (North Attleborough), Hong Kong (Kwai Chung), Singapore and Switzerland (Marin). The Marin refinery, which processes industrial gold from Africa, has an annual refining capacity of 300 tonnes. Between 2015 and 2023, Metalor refined gold from Essakane Iamgold, Taparko-Bouroum, Endeavour Mining (Wahgnion, Mana, Hounde, Boungou), Orezone Bomboré, Karma/Néré Mining, Yaramoko/Fortuna Silver Mines.

Rand Refinery: Founded in 1920, it is the only African refinery to be a member of the LBMA. It is based in Germiston, South Africa, and is active in refining, smelting and the manufacture of value-added precious metal products. Rand Refinery processes the vast majority (over 98%) of South Africa’s industrial gold. In addition to South Africa, it has confirmed that it has processed gold from the following African countries over the past five years: Ghana (which has a refinery), Tanzania, DRC, Mali, Namibia, Guinea[1], Zimbabwe, Botswana, Ivory Coast, Kenya, Zambia, Niger and Swaziland.

MKS PAMP / MMTC-PAMP: Established in 1979, MKS PAMP SA is based in Geneva, Switzerland. It is part of the MKS PAMP Group Limited, which is incorporated in Guernsey and headquartered in London, UK. The group is active in the precious metals business and provides trading, refining, storage and mine financing services. It has 5 brands, 13 offices worldwide and operates 2 gold refineries, both of which are members of the LBMA. It has refined gold for Nordgold (Taparko, Bissa Gold), Avesoro and Sanbrado over the past 5 years.

Argor-Heraeus: Founded in 1951, the Argor-Heraeus group is based in Mendrisio, in the canton of Ticino, Switzerland. It belongs to the German Heraeus technology group and has subsidiaries in Italy and Germany. The Ticino refinery of Argor-Heraeus, which is a member of the LBMA, has an annual refining capacity of 1300-1400 tonnes of gold. It has been refining gold for Wahgnion/Endeavour Mining until at least 2020.

Valcambi: Founded in 1961, Valcambi is an LBMA member refinery based in Balerna, Canton Ticino, Switzerland. It has an annual refining capacity of 1200 tonnes of gold and employs 168 people. Valcambi, which was owned by several investors, including the US mining company Newmont, has been owned since 2015 by the Indian company Rajesh Export then. It has never refined gold from Burkina Faso.

PX Precinox: Founded in 1976, PX Precinox is an LBMA member refinery based in La Chaux-de-Fonds, in the canton of Neuchâtel, Switzerland. It is part of the PX Group, a group of 10 companies in Switzerland and Malaysia. The Chaux-de-Fonds refinery refused to provide SWISSAID with its annual refining capacity. It has never refined gold from Burkina Faso.

Asahi Refining Canada is an LBMA member refinery based in Brampton, Canada. It is active in the manufacture of bullion products, refining and trading of precious metals. It did not indicate to SWISSAID its refining capacity but said it was “one of the large LBMA refineries”. The refinery was owned by the Johnson Matthey group until 2015, when it was bought by the Japanese group Asahi Holdings. Asahi Holdings has two other LBMA-certified refineries, one in the US (Salt Lake City) and one in Japan (Bando). It has not refined gold from Burkina Faso for the past 5 years.

The Perth Mint: Established in 1899, The Perth Mint is an LBMA member refinery based in Perth, Australia. It is owned by the Western Australian government and has an annual refining capacity of 800 tonnes of gold. It estimates that it processes around 10% of the world’s gold each year. The Perth Mint is one of the few refineries to provide information on its production. In its 2022 annual report, it states that it processed 549.9 tonnes of gold and silver. It did not refine gold from Burkina Faso.

Italpreziosi: Established in 1984, Italpreziosi is an LBMA member refinery based in Arezzo, Italy. It is active in the production, refining and trading of precious metals. It has an annual refining capacity of 60 tonnes. It did not refine gold from Burkina Faso.

Nadir Metal Rafineri: Established in 1967 as Nadir Metal, this refinery is a member of the LBMA based in Istanbul, Turkey. It has an annual refining capacity of 125 tonnes of gold and employs 163 people. It did not refine gold from Burkina Faso.

Fidelity Gold Refinery Founded in 1966, Fidelity Gold Refinery (FGR) is a refinery based in Harare, Zimbabwe. It has been active in gold refining since 1987 and has an annual refining capacity of 50 tonnes of gold. It is owned by the Reserve Bank of Zimbabwe (RBZ) and was known as Fidelity Printers & Refiners until 2021. FGR lost its LBMA certification in 2008 after producing less than 10 tonnes of gold, the annual minimum required to be certified to the LBMA standard. It refined gold from Zimbabwe.

Refineries in the United Arab Emirates and China: Zimbabwe’s industrial gold mines export (via Fidelity Gold Refinery) their gold to the United Arab Emirates. The Hassai mine in Sudan, operated by Ariab Mining Company, to the UAE’s Kaloti refinery, renamed MTM&O. Liptako Mining Company (SML) of Niger sent its gold to LYS International FZE, a Dubai-based company. Gold from the Gabgaba mine in Sudan is refined not only by Emirati refineries Al Masqual and Emirates Minting. Caracal Gold has exported some of the gold from its Kilimapesa mine in Kenya to Emirates Gold DMCC. Gold from Nordgold’s mines in Burkina Faso is also reported to be heading to Dubai from 2022. Gold from the Guelb Mohgrein mine in Mauritania is exported to China.

Unidentified business relationships

The Kodiéran mine in Mali, operated by Faboula Gold (formerly Wassoul’or). The EITI Mali 2018 report indicates that gold from this mine has been exported to the United Arab Emirates in the past. Since 2022, gold from this mine is reportedly being delivered to the German company Pearl Gold AG.

The Abujar mine in Côte d’Ivoire, operated by Tietto Minerals, which began commercial production in 2023.

The Ndassima mine in the Central African Republic. The Canadian company Axmin had the licence to operate this mine before being dispossessed in favour of Midas Ressources. The mine is now controlled by the Wagner group and the gold is exported to Russia, according to the media Jeune Afrique.

The Koka (Zara) mine in Eritrea, jointly owned by the Chinese group SFECO and the Eritrean national mining company ENAMCO.

The Bisha mine, also in Eritrea, produced a lot of gold between 2011 and 2013 before turning to copper and zinc mining for the most part.

The Sakaro mine in Ethiopia, operated by MIDROC.

The Manica mine in Mozambique, operated by Mutapa Mining & Processing LDA (MMP) and owned by Xtract Resources.245 The first gold bar from this mine was poured in 2022.

Some semi-industrial mines have also been identified in Sudan. These include the Abu Sari mine, operated by Delgo Mining248 and Block 30, operated by Alliance for Mining and Kush E&P.

Summary by Elie KABORE

Source: SWISSAID Foundation report (From shadow to light: The Business Relationship between Industrial Gold Mines in Africa and Refineries) published on 30 March 2023.

#Mines_Actu_Burkina