- Because of related institutional dysfunction

- Build up a body of extractive sector tax specialists in the countries concerned

- Develop specific audit capabilities

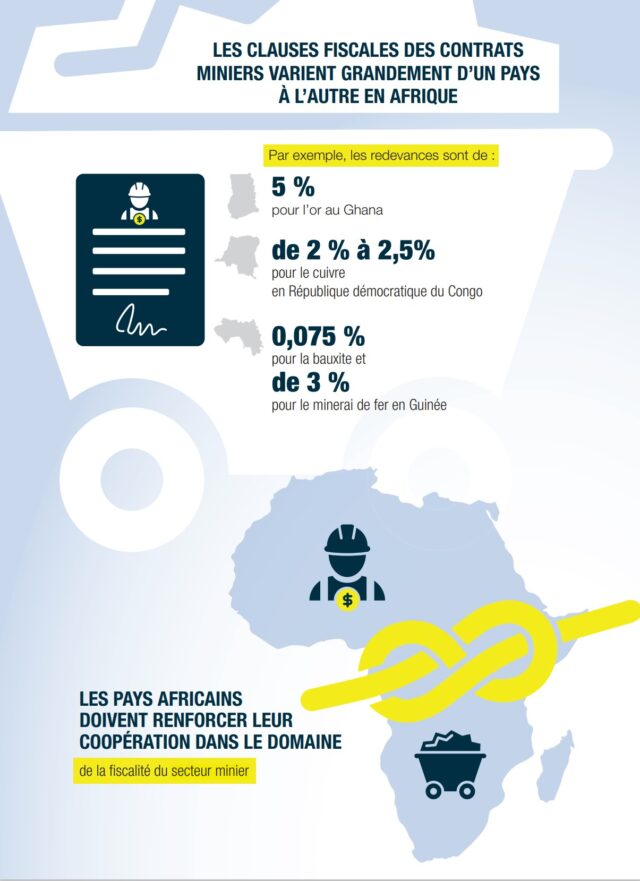

Research into the potential sources of illicit financial flows (IFF) in different sectors shows that the production of a metal such as gold is more likely to generate IFF than the production of an agricultural product such as cocoa. These are the findings of the United Nations Conference on Trade and Development (UNCTAD) 2020 Report on “Illicit Financial Flows and Sustainable Development in Africa”, published in August 2020. According to the report, there are three main sources of IFF in the extractive sector, including the proceeds of corruption (abuse of function by a public official for personal gain), revenue from the illegal exploitation of resources, which deprives the State of its legal share, and tax evasion at the initiative of the investor. These 3 sources are not mutually exclusive and are often combined. The first, corruption and related institutional dysfunction, is often considered to be the major determinant of the negative relationship between natural resource wealth and the degree of development, and has inspired the expressions “resource curse” and “paradox of abundance”. The second source, the illegal exploitation and trade of minerals, is on such a scale that it has given rise to various transparency initiatives, including the Kimberley Process Certification Scheme, which have helped to determine the order of magnitude of the gap between actual and declared production in the minerals sector. It was established that if smuggling and under-reporting were taken into account, global diamond production was almost twice as high as previously estimated. To guard against the third source, tax evasion, countries need to assess the costs and benefits of building up a body of tax specialists in the extractive sector. If the tax authorities consider that there is a significant and consistent discrepancy between the market and the values declared by exporters, it may be cost-effective to invest in intelligence gathering and expert services, as well as in the laboratory services needed to verify and possibly challenge the values declared by exporters. Developing sector-specific audit capabilities can be a costly and arduous task, as it requires in-depth knowledge of how prices are set and agreements reached for each product. Tax auditors also need to have an intimate knowledge of the implications for tax returns of certain elements specific to the extractive industries, including the import of specialist machinery, the purchase of technical services and hedging and financing arrangements, which can be more difficult to assess. Finally, the more general issues raised by tax avoidance, such as the taxation of capital gains and indirect transfers, are also largely relevant to mining value chains.

Summary by Elie KABORE

#Mines_Actu_Burkina