This article was published by the newspaper La Guardia Magazine in the Democratic Republic of Congo.

Since 2018, the Mining Code of the Democratic Republic of Congo has set the mining royalty rate. It is 3.5% for metals and 10% for strategic minerals. This royalty is deducted from the total number of exports. However, there are sometimes inconsistencies between imports and the low mining royalty paid by certain companies, including Kamoto Copper Company (KCC). KCC is a company operating in Lualaba province in the south of the DRC.

KCC is a joint venture between the state-owned company Générale des Carrières et des Mines (GECAMINES), which owns 25% of the shares, and Glencore, which owns 75%. It holds mining licences in the province of Lualaba. In this part of the DRC, it mainly mines copper and cobalt.

Between 2019 and 2020, an analysis of the export data contained in the Glencore 2020 reports and the EITI data reveals significant discrepancies between mineral exports and the low royalty paid in these two years. For example, in 2019, KCC paid a mining royalty of 33,700,000 USD for an export of 17,100 tonnes of cobalt. At the same time, it produced 234,500 tonnes of copper. In 2020, the company paid 35,800,000 USD for an export of 23,900 tonnes of cobalt and 270,700 tonnes of copper.

Significant differences

Meanwhile, Glencore reported in its 2019 production report that the price of copper was 6,005 $ per tonne. This price, multiplied by 234,500 tonnes of copper, gives an export value of 1,408,172,500 US dollars. For cobalt, the report gives a price of only 16 $ per pound. One tonne is equivalent to 2204.623 pounds. Multiplying 2204.623 pounds by 16$ gives the price of a tonne of cobalt. In 2019, the price of cobalt was 35,273$. This amount multiplied by 17,100 tonnes of cobalt would have generated 603,168,300 USD.

In 2020, the copper price given by Glencore in its 2020 report is 6,186 USD per tonne. Multiplying 270,700 tonnes of copper by 6186 $ gives an export value of 1,670,220,000 $. For cobalt, the Glencore report gives a price of 21 $ per pound. Given that one tonne is equivalent to 2204.623 and a price of 21$ per pound, the price of cobalt in 2020 was 46,297$ (2204.623X 16$). Applying this price to the 23,900 tonnes of production, the export value would be 1,106,498,300 $.

What does the Mining Code say?

In accordance with Article 240 of the Mining Code, mining royalties are collected on exports: “Mining royalties are calculated and payable when the merchantable product leaves the extraction site or processing facilities for shipment”. According to Article 241 of the Mining Code, “the rates of mining royalty are : (..) 3.5% for precious metals, (..) g. 10% for strategic substances”.

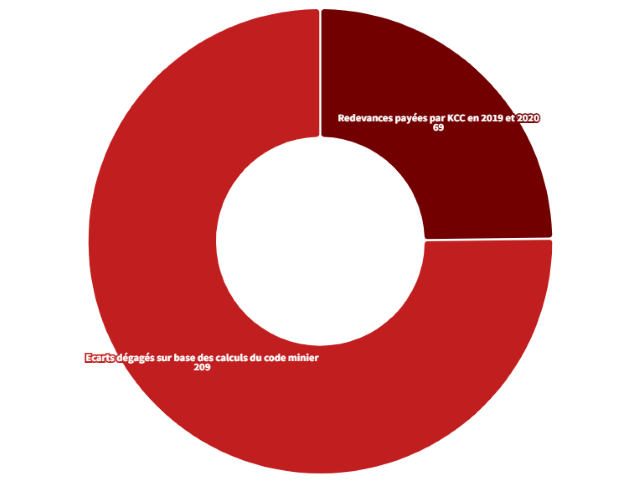

Thus, by applying the rate in accordance with Congolese legislation, in 2019 KCC would have had to pay a total copper royalty of 49,286,037.5 $ (i.e. 3.5% of 1,408,172,500 $). For cobalt, 60,316,830$ (10% of 603,168,300$). Summing these two amounts gives 109,602,867.5$. Subtracting the royalty paid by KCC (33,700,000$) gives a gap of 75,902,867 $ for 2019.

In 2020, it would have had to pay a copper royalty of 58,457,700.5$ (i.e. 3.5% of 1,670,220,000$) and 110,649,830$ (i.e. 10% of 1,106,498,300$). This means that KCC should have paid 169,107,530$. If the royalty paid of 35,842,666.01 USD is deducted from this figure, the shortfall is 133,264,863.99$. In sum, based on these figures for the two years 2019 and 2020, the total shortfall would be 209,210,397.5 $.

Division des Mines statistics

Other sources provide different figures. According to estimates from the Division des Mines du Lualaba, in 2020 KCC was due to pay 135,737,453.05 in mining royalties. If we deduct the amount paid by KCC, there is also a gap of 99,894,787.04 $ for 2020 alone.

TFM paid more while exporting less

What could explain these discrepancies? Emmanuel Umpula, an expert in mining issues, believes it is due to the fact that the ores have different grades: “The grade of the ores can lower the price”. But according to the EITI report, in 2019, Tenke Fungurume Mining (TFM), a company operating in the same province, exported fewer ores, but paid more in royalties.

Indeed, TFM (this analysis does not address whether TFM is transparent or not) exported 177,956.37 tonnes of copper and 16,098.67 tonnes of cobalt for a total royalty of 92,800,000 USD in 2019. Between TFM’s exports and those of KCC, there is a difference of 56,543.64 tonnes of copper and 1,001.33 tonnes of cobalt. At the same time as exporting fewer 56,543.64 tonnes of ores than KCC, TFM paid 55,100,000 USD more in royalties than KCC. What’s more, KCC’s copper and TFM’s copper are enriched to the same percentage, i.e. 99.9%. And yet the differences in payments for these two companies are very large.

The Congolese state loses through inaction

This situation is astonishing. Companies are paying less in royalties and the state is not paying much attention. Richards Mukena, a member of the NGO African Ressources Watch, explains why: “We have a declaratory system, and the State is satisfied with what the company has paid instead of following up”. Freddy KASONGO, Executive Secretary of the NGO Observatory of Studies and Support for Social and Environmental Responsibility (Observatoire d’Etudes et d’Appui à la Responsabilité Sociétale et Environnementale – OEARSE), agrees. In his view, it is difficult for the mining administration to independently verify the production and sales declared by companies. He suggests that the Congolese government should adopt new methods. “It will therefore be important to examine the possibility of using remote monitoring technology. This could enable the tax authorities to increase revenue collection from the sector”, he says.

This shortfall in the payment of mining royalties is having an impact on the development of the mining province of Lualaba. Funds that could be used to build roads such as the 424 km road between Kolwezi and Sandoa. Travelling on this road is an ordeal. MP Donnât Tshimboj experienced this first-hand in March 2023. “I had to take a motorbike to get from Kolwezi to Sandoa,” he says. And yet, if KCC or other mining companies paid their mining royalties properly, that money would be used to build even more roads than this one.

This lost revenue could also have been invested in local development. Fanfan Mwema is a construction engineer in Lubumbashi. He explains, for example, that it costs 200,000 $ to build a good quality school with six classrooms and 80,000 to 100,000 $ to build a health centre. This shortfall represents 1,000 schools and 2,000 health centres.

KCC has not responded

In the interests of balance, we have tried to give the floor to KCC. However, all our attempts to get KCC’s side of the story proved futile. We wrote to KCC on 22 June 2023. An acknowledgement of receipt was sent to Glencore’s media office on 28 July 2023. On 11 July 2023, we wrote to KCC again, with an acknowledgement of receipt forwarded to Glencore on the same day. On 21 July, we wrote again by e-mail to KCC’s Communications Department. Glencore’s representative in the DRC, Marie-Chantal Kaninda, assured us that the company would respond. Despite this, and up to the date of publication, KCC has not responded to our requests.

This article was written by La Guardia Magazine as part of ‘The Wealth of Nations’, a pan-African media skills development programme run by the Thomson Reuters Foundation in partnership with TrustAfrica. More information on The Wealth of Nations. The Thomson Reuters Foundation is not responsible for the content published, which is the sole responsibility of the publishers.