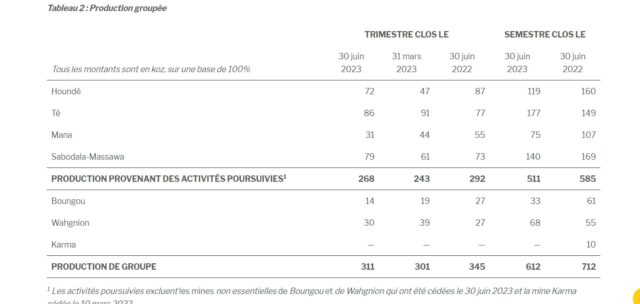

Endeavour Mining group produced 268,000 ounces of gold in the second trimester of 2023 at a production cost of 1,000 $/ounce. Production for the first semester of 2023 is estimated at 511,000 ounces with production costs of 978 $/oz. Endeavour Mining reports dividends of 100 million dollars (approximately 60 billion FCFA) for the first half of 2023. Endeavour Mining is on track to meet its guidance for 2023. Finally, research projects are on budget and on schedule. This is the summary of Endeavour Mining’s operational and financial results for the first semester of 2023, published on 2 August 2023 in London.

Sébastien de Montessus, Chairman and Chief Executive Officer, said: “We are satisfied with our achievements in the first semester. We have continued to meet our strategic objectives, which puts us in a good position to deliver near-term value for all our stakeholders”.

As a reminder, Endeavour Mining is a West African gold producer with mines in Burkina Faso, Côte d’Ivoire, Senegal, with advanced development projects and exploration assets in the highly prospective Birimian greenstone belt in West Africa.

But on 30 June 2023, it sold the Boungou and Wahgnion mines in Burkina Faso to Lilium Mining for 300 million dollars. Sébastien de Montessus explains the sale: “In line with our commitment to actively manage our portfolio in order to focus on higher quality assets, we completed the sale of our non-core Boungou and Wahgnion mines during the period”. Following this transaction, the Group intends to focus on the expansion of the Sabodala-Massawa brownfields (Senegal) and the Lafigué Greenfield project (Ivory Coast), which are on budget and due to come on stream next year, and will generate significant growth.

Higher production costs in the second trimester

Production at the Group’s operations in the second trimester was 10% higher than in the first trimester of 2023, due to higher output at Houndé and Sabodala-Massawa. These mines encountered higher grade ore, which partially offset lower production at Ity and lower throughput at Mana, due to the development of the underground mine. In the second trimester, production costs were 5% higher than in the first trimester. The main reason for this increase was higher costs at the Ity mine due to the increased use of self-generated energy. The Mana mine also contributed to the increase, due to investment in underground development. However, lower costs at Houndé and Sabodala-Massawa partially offset the increases.

A jackpot for shareholders Endeavour’s results release stated: “The Company is pleased to continue to generate attractive returns for shareholders, despite the significant growth capital investment undertaken this year. Endeavour’s objective is to increase its shareholder return programme once its organic growth plans are complete in 2024, ensuring that its efforts to unlock growth immediately benefit all of its stakeholders”.

Elie KABORE

#Mines_Actu_Burkina