Between January and June 2023, Burkina Faso produced 27.527 tonnes of gold. This is 9.6% less than in 2022, when 30,441 tonnes of gold were produced in the first semester of the year. There are many reasons for this drop, but the main one is the lack of security, which is having a negative impact on mining in Burkina Faso. Security incidents on the roads leading to mining sites are disrupting the transport of personnel and the supply of goods and services.

Investments in securing mine sites, transporting workers by air and securing land supply convoys are increasing costs. But each mine is experiencing the consequences of insecurity in its own way. An analysis of the financial results published by the mining companies themselves shows that the rise in the price of gold on the world market has lessened the impact of insecurity. The impact of insecurity on the mines is measured in terms of production costs per ounce of gold. The Essakane mine has the highest production costs per ounce of gold. In the second trimester of 2023, Essakane spent 1,376$ to produce an ounce of gold. However, the company is benefiting from a good gold price of 1,943.6 USD per ounce in June 2023, which is helping to mitigate the high production costs.

Boungou and Wahgnion saw their production costs rise in the second trimester, because Endeavour, which operated them, prioritised the sale of these two mines over production during the period.

In addition to these mines, Roxgold has the lowest production costs per ounce of gold at 719$. The same is true of Orezone, with production costs of 1,109$ in the second trimester of 2023. Houndé Gold, which was at 1,154 $ per ounce of gold in the first trimester, would be at 1,085$ per ounce of gold in the second trimester. Mana, which spent 1,130$ per ounce of gold mined in the first trimester of 2023, would be at 1,481$/oz in the second trimester of 2023. Finally, SOMISA spent 1,175$ to produce an ounce of gold in the second trimester. According to statistics from the Ministry of Mines, during the second trimester, the price of gold fluctuated between 1,810.95 dollars per ounce and 2,037 dollars per ounce. The difference between these production costs and the average price of gold indicates that almost all mining companies in Burkina Faso are reaping huge profits.

Many reports published by the companies themselves confirm their sound financial health. Some are even making major investments to increase production and take advantage of rising gold prices. Others have no qualms about overproduction, i.e. producing more than planned in order to take advantage of the buoyant gold price. Overproduction is punishable under the Mining Code, but the penalties are so insignificant as to encourage this bad practice, which allows the company to extract as much ore as possible ahead of schedule.

It is Burkina Faso that is losing out because of the lack of rigorous monitoring of production and the failure to crack down on overproduction.

Pending the revision of articles 54 and 55 of the Mining Code to remedy this shortcoming, the government has a lever that it has been slow to use. This is to raise the royalty rate.

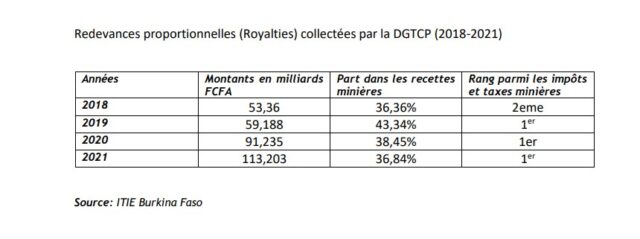

Indeed, under the terms of Decree no. 2017-0023/PRES/PM/MEMC/MINEFID of 23 January 2017, setting mining taxes and royalties, royalties are levied in Burkina Faso in a progressive manner: 3% if the price of gold is less than 1,000$ per ounce; 4% if it is between 1,000$ and 1,300$ per ounce; 5% when it exceeds 1,300$ per ounce. Since 2019, the price of gold has exceeded 1,900 dollars an ounce. But legislation is not in place to capture the windfall from this rise. Burkina Faso will not benefit from this rise in gold prices because of the cap on the rate of royalties collected at 5% if the price of gold exceeds 1,300 dollars an ounce, as if the price would never exceed this level. A draft text was prepared but never adopted. It is high time for the Ministries of Mines and Finance to revise this decree as soon as possible to increase the tax on royalties above 1,300 dollars an ounce, so that the country can capture the mining income in this context of rising gold prices. A progressive system could be envisaged: 6% if the price reaches 1,500 dollars, 7% if it reaches 1,800 dollars, 8% if it reaches 2,000 dollars. This revision, which is even included in the Transition agenda, could enable Burkina Faso to capture around 30 billion FCFA a year in royalties. The mines that are making super profits will have nothing to do but comply and contribute to the construction of the country.

Elie KABORE

#Mines_Actu_Burkina