- 25 tonnes of gold produced in 2021

- 1,232 billion FCFA of economic contribution to the sub-region

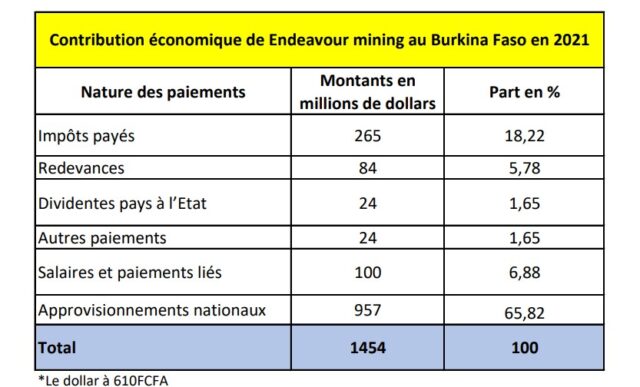

- Figures contained in the 2021 report on the company’s economic and fiscal contribution

What is the economic contribution of mining companies in West Africa? According to the Minister of Energy, Mines and Quarries, Simon Pierre Boussim: “the contribution of the mining sector to the economic development of the country of honest men is no longer in question. In terms of statistics, the latest BCEAO report indicates that our country is the 2nd largest gold producer in the WAEMU area, increasing from 5.6 tonnes of gold in 2008 to around 61 tonnes in 2021.

25 tonnes of gold produced in 2021

To present its economic and fiscal contribution, the mining company Endeavour Mining organised a ceremony on 16 December 2022.

The presentation provided an overview of Endeavour Mining’s fiscal and economic contributions in the main countries and territories in which it operates. In West Africa, the mining company injects 2 billion dollars, or 1,232 billion CFA francs, into the economies of Senegal, Côte d’Ivoire, Burkina Faso, and Mali.

In Burkina Faso, the group’s total production in 2021 is 25 tonnes. Its contribution to economic development is estimated at 894 billion FCFA in 2021. The report disaggregates this data. Of the 894 billion FCFA, 61.625 billion FCFA was invested in salaries and related payments, 589.756 billion FCFA was allocated to national supplies. For tax payments, the mine injected about 163.305 billion CFA francs in tax payments, as well as 244.510 billion CFA francs in other contributions.

Tax incentives

As a reminder, Endeavour mining operates 04 gold mines in Burkina Faso including Houndé gold, Semafo Mana, Semafo Boungou and Wahgnion gold. However, Houndé gold and Semafo Mana are operated under the regime of the 2003 mining code. This mining code provides for numerous fiscal arrangements, including a reduced rate of tax on company profits of 17.5% compared to a standard rate of 27.5%. Although the 2015 mining code removes this benefit, these mines continue to benefit from the reduced tax rate through stabilisation under the various mining conventions.

Rachid Ouédraogo

#Mines_Actu_Burkina