- A good ranking compared to previous years

- Nevada, Western Australia and Saskatchewan, the top three

- The least attractive: Zimbabwe, Mozambique, South Sudan and Angola

- Morocco leaves top 10 most attractive countries

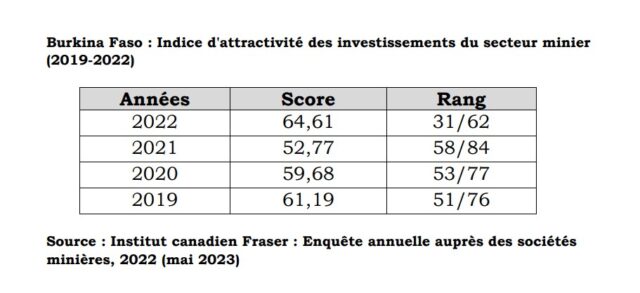

Burkina Faso’s attractiveness in terms of investment in the mining sector is not brilliant. According to the annual survey of mining companies, 2022 published on 3 May 2023 by the Canadian Fraser Institute, Burkina Faso ranked 31st in 2022 out of 62 countries, with a score of 64.61 out of 100. In 2022, Burkina Faso’s score improved compared to 2021, 2020 and 2019, when it ranked 58th out of 84 countries, 53rd out of 77 countries and 51st out of 76 countries respectively.

The Canadian Fraser Institute has been publishing this annual survey of mining companies for years. For the year 2022, the survey covered 62 countries around the world. It assessed how public policies such as taxation and regulatory uncertainty encourage or discourage mining investment.

Information for the 2022 report was collected electronically from 1966 respondents between 23 August and 30 December 2022. Responses were used to rank provinces, states and countries according to the extent to which public policy factors influence investment in the sector.

According to the respondents, geological and economic considerations are key factors in mineral exploration. The same applies to the political context, which is an important investment consideration.

Based on the responses, an overall Investment Attractiveness Index is calculated by combining the Best Practices Mineral Potential Index. The index rates regions according to their geological attractiveness, and the policy perception index according to context.

This context takes into account a range of considerations affecting investment decisions, such as regulatory administration, the legal system, the tax regime, environmental policy, infrastructure, socio-economic development conditions, political stability, labour regulations, security and the availability of labour and skills.

Nevada, Western Australia and Saskatchewan, the top three

Uncertainty over protected areas and disputed land claims, infrastructure, socio-economic and community development conditions, trade barriers, political stability, labour regulations, the quality of the geological database, security and the availability of labour and skills, according to the report.

The world’s leading jurisdiction for investment based on the Investment Attractiveness Index is Nevada, which moved up from 3rd place in 2021. Western Australia, which topped the rankings last year, came in 2nd this year. Saskatchewan continues to be on the podium, moving up slightly from 2nd in 2021 to 3rd this year. Newfoundland and Labrador, Colorado, the Northern Territory, Arizona, Quebec, South Australia and Botswana round out the top 10. The United States, Canada and Australia each have three jurisdictions in this year’s top 10, followed by Africa. Botswana has taken the second place held by Morocco (which has left the top 10) in 2021.

The least attractive: Zimbabwe, Mozambique, South Sudan and Angola

Considering both political and mining potential in the investment attractiveness index, Zimbabwe ranks as the least attractive jurisdiction in the world for investment, followed by Mozambique, South Sudan and Angola. Furthermore, in the bottom 10 countries (starting with the least attractive for investment) are Zambia, South Africa, China, the Democratic Republic of Congo, Papua New Guinea and Tanzania. Africa is the region with the most jurisdictions (8) in the bottom 10 jurisdictions. Asia and Oceania each have one court in the bottom 10.

R O

#Mines_Actu_Burkina