- The Constitution sets out the fundamental principles governing the conduct of economic activities

- Mining codes that do not improve socio-economic performance

- Most African countries did not have an appropriate transfer pricing framework.

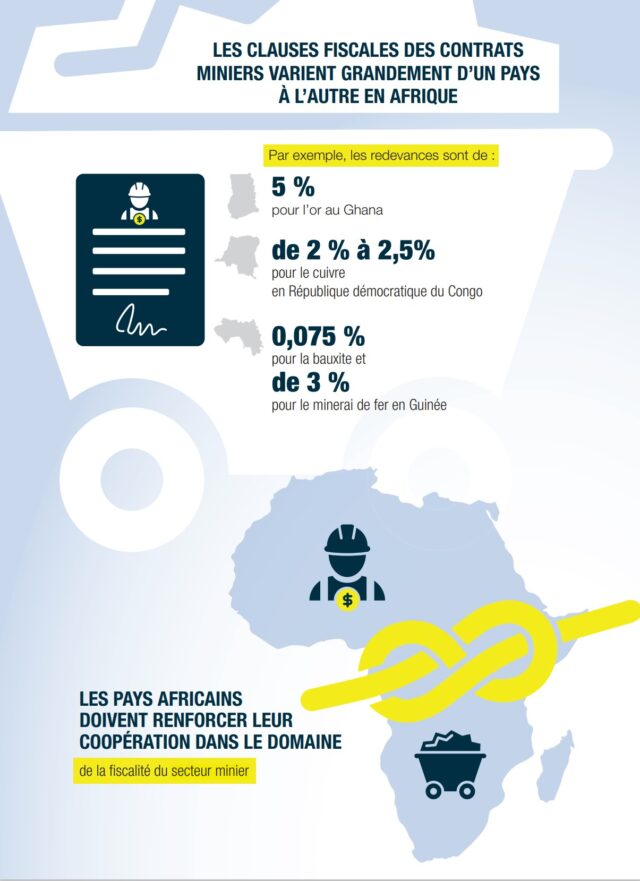

- Variation in extraction taxes between countries: between 0.075% and 5%.

- Stabilisation clauses freezing the application of domestic law

- African countries have adopted mining policies that provide a framework for mining activities.

These policies and mining activities in Africa should be guided by the African Union’s Vision for Africa’s Mining Regime. Mining operations should also be subject to compliance with a series of international guiding principles, including the United Nations Guiding Principles on Business and Human Rights. These are soft law instruments and therefore not legally binding. This is what emerges from the United Nations Conference on Trade and Development (UNCTAD) 2020 Report on “Illicit Financial Flows (IFFs) and Sustainable Development in Africa” published in August 2020.

For the purposes of this report, the extractive sector is subject to the host country’s hierarchy of legal norms. The way in which international instruments are incorporated into the domestic legal system varies from one country to another; national legislation applies by default in the absence of a special normative text establishing that international law takes precedence over domestic law. At the top of the hierarchy of legal norms is the Constitution, which takes precedence over the body of national legislation, including the Mining Code as well as laws on investment, trade, taxation, labour protection, infrastructure and environmental protection and other country-specific texts. The Constitution sets out the fundamental principles governing the conduct of economic activities, such as the sovereignty of the State over natural resources, the ownership and protection of property, the protection of local communities and the protection of the environment and human rights. It enshrines the permanent sovereignty of the State over natural resources, the right of citizens to a healthy environment and the need to protect the environment for the benefit of present and future generations.

Constitutional law also governs the distribution of prerogatives between the various entities and agencies of the state. For example, Ghana’s constitutional law requires parliament to approve all mining contracts involving the granting of rights or concessions by the executive authorities. FDI projects in the extractive sector are also governed by the legal provisions governing investment, in particular the tax code and environmental and foreign exchange regulations.

This legislative arsenal is imposing, but most countries do not have sufficient capacity to implement and enforce it, in particular to detect IFFs. The World Bank’s in-depth analysis of transfer pricing legislation in Africa showed that most African countries do not have an appropriate transfer pricing framework. Transfer pricing is governed either by general tax law or by financial legislation. Countries with legislation to tackle tax evasion include Côte d’Ivoire, Madagascar, Mali and Sierra Leone. Most countries have mining codes, but despite the African Union’s adoption of the African Mining Vision (AMV), which aims to make the African mining sector a driver of the continent’s transformation, many analyses show that even in periods of soaring commodity prices, many mineral-rich countries have failed to improve their socio-economic performance. Growing concern over the mining sector’s modest contribution to development, data on the scale of IFFs and the entry into the fray of civil society organisations working for transparency have reinforced a trend that has led some African countries to revise their mining codes.

Mining contracts in African countries

The report analyses mining contracts in African countries. It shows that mining contracts are very common throughout the extractive sector, complementing domestic legislation. An analysis of contracts concluded by a sample of three countries (Democratic Republic of Congo, Ghana and Guinea) for gold, copper and cobalt, aluminium and bauxite shows that their tax clauses vary widely. The extraction tax, for example, can range from 5% of revenues for gold, as prescribed in Ghana’s mining code, to 0.075% for bauxite and 3% for iron ore in Guinea. The treatment of subsidiary transactions also differs from one mining contract to another. In Guinea, for example, the provisions in the contracts signed with a number of companies differ with regard to the obligation to comply with best practice in transfer pricing and the State’s right of pre-emption to acquire mining substances if it considers the transfer price to be too low. In the Democratic Republic of Congo, on the other hand, contracts make no mention of such transactions, and the 2018 Mining Code states only that transactions between subsidiaries must take place on an arm’s length basis.

An examination of publicly available mining contracts in a sample of African countries shows their major role in mining investment on the continent. Their provisions on state participation vary, with shares held either by state-owned companies or by the state. More and more mining contracts include a provision for the mining company to contribute to development. In the contracts consulted, this contribution ranges from 20% of royalties in Ghana, in accordance with its domestic law, to 0.5-1% of revenues in Guinea, under a local development agreement to be concluded between the mining company and the local community. These mining contracts also regularly include a stabilisation clause that freezes the application of the relevant domestic law for the duration of the project. Contracts are normally concluded under, and subject to, domestic law, but mining contracts often incorporate provisions of international law or provide for recourse to international dispute settlement mechanisms, a provision that is just as common in bilateral investment agreements concluded by most investors’ home countries with African host countries.

Summary by Elie KABORE

#Mines_Actu_Burkina