A year ago, in 2022, Giorgia Meloni, the Italian prime minister, suggested that 50% of the gold exported from Burkina Faso ended up in the coffers of the French state. Since then, more and more people in Burkina Faso have taken to social networks to suggest that France levies taxes on gold produced in Burkina Faso. But what do the laws say? Which companies mine gold in Burkina Faso? What are their links with France? What taxes do these companies pay? Do they pay any revenue back to France?

Mining in Burkina Faso is governed by the Mining Code. This law requires any company wishing to exploit ore to set up a company under Burkina Faso law. In other words, the investor must create a company with an IFU number and a trade register before making an application. The company then signs an agreement with the government and undertakes to pay taxes, duties and royalties in accordance with the law.

The only document that brings together all the payments made by mining companies is the report published by the Extractive Industries Transparency Initiative (EITI). It is this report that reconciles the payments made by the mining companies and the sums received by the State. The companies exploit gold and wind to whoever they want.

The latest report covers fiscal year 2020. Mining companies’ declarations must be certified by a chartered accountant. The report covers 55 payment flows, the most important of which are proportional royalties. Other payments include customs duties and similar taxes, the single tax on wages and salaries (IUTS), value added tax (VAT), the provisional advance on corporation tax, dividends, withholding tax, tax on income from transferable securities, registration fees, the employer’s apprenticeship tax (Taxe Patronale d’Appren – TPA), surface tax, the local mining development fund, etc.

How did gold come into use? In practice, each company sells its gold and pays taxes to the state. According to a SWISSAID report published in March 2023, the gold produced in Burkina Faso was sold mainly in Switzerland by Metalor and MKS PAMP SA companies. Sales were also made to refineries in South Africa (Rand Refinery), Canada, Dubai, China, etc.

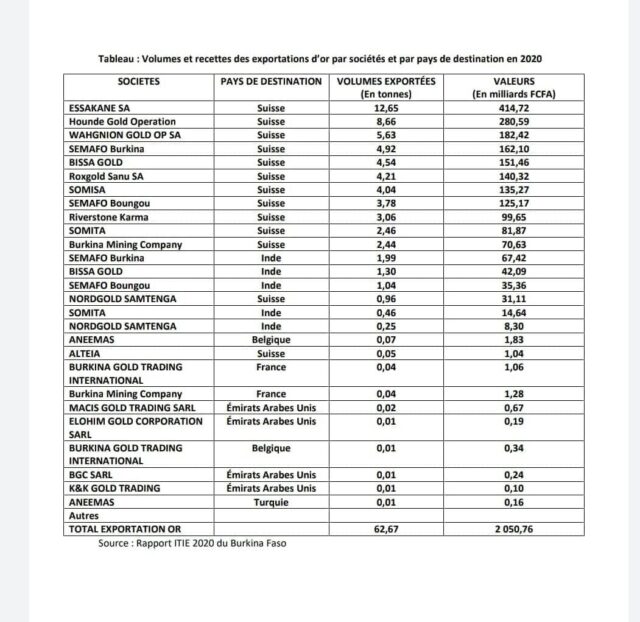

According to the EITI’s 2020 report, in addition to Switzerland, which receives 91.6% of industrially produced gold, small quantities have been mined in India, France, the Arab Emirates, Belgium and Turkey.

As you can see, the State is not involved in the sale of gold. The proceeds of gold sales are repatriated to accounts in Burkina Faso. The role of the State is therefore to check sales invoices to ensure that payments are in line with sales in order to avoid fraud.

What’s more, most of the mining companies exploiting gold in Burkina Faso are Canadian (Endeavour, Iamgold, Traveli, Avesoro, Fortuna, Orezone) alongside Russia’s Nordgold, Australia’s West African Resources and Burkina Faso’s Nééré.

It is hard to imagine how a company that raises funds to carry out research with the risk of finding nothing, apply for a mining licence and sell its gold can pay part of these revenues to France with impunity. At what point does 50% of this revenue go to France? It’s hard to imagine!

Mines Actu Burkina with Infoh24