Burkina Faso has begun the process of reviewing the 2015 Mining Code. Mines Actu Burkina spoke to Adrien Somda, a lawyer by training, tax inspector and expert in the taxation of extractive industries. He is one of the instructors at the 12th session of the summer university of the Centre of Excellence for the Governance of Extractive Industries in Francophone Africa (CEGIEAF) and the Catholic University of Central Africa (UCAC) in Yaoundé, Cameroon. He calls for in-depth, structuring reforms to the Code to bring it into line with people’s development aspirations.

Mines Actu Burkina: Is it appropriate and necessary to revise the Mining Code at this stage?

Adrien Somda: Yes, I think that the particular context of Burkina Faso, which has been going through a security crisis for nearly a decade now, and also the Covid crisis, may have revealed the inadequacy of the Mining Code, which had not foreseen the health crisis and the long-term security crisis. The mines are located outside inhabited areas, with long-term activities. I think it’s appropriate that the issues raised by the crisis, particularly access to certain areas, should be taken into account. The peaceful enjoyment of mining rights by mining operators is not effective in these areas. The Code does not provide sufficient room for manoeuvre in the event of a crisis such as the current one. As a result, there is no legal basis on which to resolve a number of problems. I’m referring to the renewal of permits, the payment of fees linked to the granting of mining permits, the cessation of activities, and so on. Some companies are in situations where they have finished research and should be at the exploitation stage, but they are unable to do so because of the insecurity. So we have a whole raft of constraints, and yet the companies have committed huge sums of money. So we need to go through the legal channels, and have the tools we need to manage the situation in the best possible way, so that we remain an attractive country for investors. This can be a positive signal, provided that the reform focuses on a number of solutions to make up for the shortcomings that have been revealed.

What reforms are needed to make the Mining Code effective?

The implementation of this code has revealed limitations in terms of administrative management. In terms of the mining cadastre, for example, this reform could help to bring greater transparency and generate more revenue.

As far as the Local Development Mining Fund (LDMF) and the funds for rehabilitating mining sites (industrial and artisanal) are concerned, their implementation remains a challenge for the authorities in terms of the use of the resources collected. I think that these funds should be reorganised in depth, in the sense that the mechanisms of the LDMF allowed for the full distribution of the resources collected. And we have seen the consequences of the absence of a fund for future generations, for which we had begun to think. It is important that we think about setting up this fund, which will be supplied by the resources generated by mining activity. If this tool existed, the war effort could have found resources. All we had to do was place the fund in financial centres that paid interest on the principal and we could have recovered the interest generated to feed the war effort.

If, for example, 0.01% of the LDMF’s resources were kept to form a reserve that could be invested in financial markets, the interest could be used to help the war effort without affecting the principal that will be allocated to local authorities for structural investments. We note that this security crisis is destroying investment from local authorities and communities. We will therefore have to rebuild. I hope that the review of this fund will go a long way towards providing for the reconstruction of town halls, schools, roads and broken bridges. It won’t be the only source of funding, but it can help to restore things. These are major elements.

From a technical point of view, I think it’s important to keep a close eye on the enthusiasm surrounding the extension of mining permits requested by mining companies operating in Burkina. We also have the rejection regime, and the fine coal affair should be a wake-up call, telling us that there may be a shortcoming in the system. The reform should make up for this shortcoming and may enable us to move towards making rejections an opportunity for nationals. It is possible to move in the direction of saying that nationals should invest more, if not exclusively, in reprocessing mining waste. This will lead to a ban on its export and avoid scandals like those we have seen.

What kind of reforms are needed for the environmental rehabilitation fund?

Not being an environmentalist, we feel that the blockage lies in the competence of the administrations to manage this fund. And when the 2019-2020 EITI reports were being drawn up, we proposed that an account be opened at the BCEAO under the responsibility of the Environmental Intervention Fund (Fonds d’intervention pour l’Environnement – FIE) to transfer the funds, which are tax-exempt public money. Well before that, audits are needed to monitor the management of the money.

Since the security crisis, the National Office for the Security of Mining Sites (Office National de Sécurisation des Sites Miniers – ONASSIM) has had difficulty securing mines. Should it be abolished?

Since the crisis began, ONASSIM has been unable to secure the mines. So why persist in keeping an organisation that is struggling to fulfil its security missions? I think that experience teaches us. In my opinion, the task of making mines safe belongs to a ministerial department. There may be a waste of resources, so we need to refocus and evaluate ONSSIM’s actions, and have the courage and honesty to say that it is not its role to secure mining sites. The security approach needs to be reviewed, and security means committing the financial and logistical resources to do it.

In terms of taxation, what aspects of the Mining Code need to be improved?

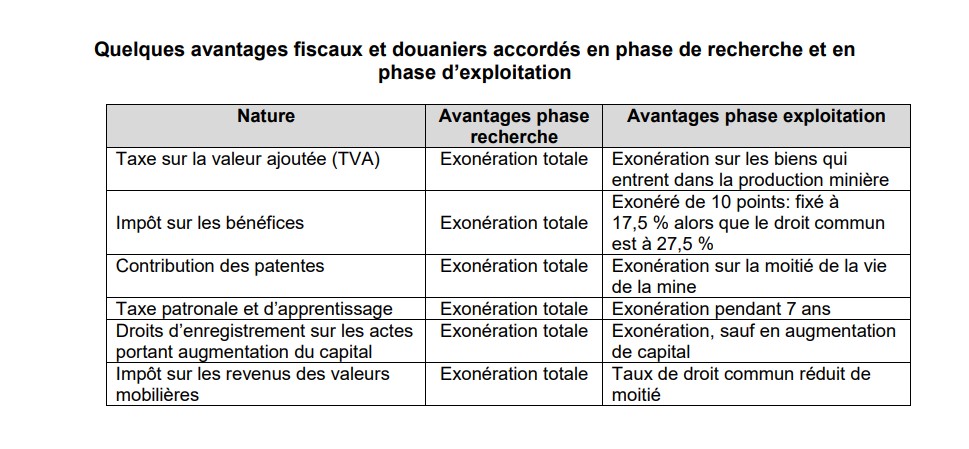

I think it would be a good idea to evaluate the tax system and the tax levy beforehand. Another major point is that the rules governing tax bases need to be removed from the scope of tax stabilisation.

Some progress has been made, and this must be emphasised. The current tax system is robust, with the exception of certain exemptions. These exemptions must be indexed to specific economic factors. Certain tax breaks should be indexed to the level of investment made.

The other aspect is the project related to the operation of the mine. We saw Tambao, which had to rebuild the railway and develop the towns through which ore was transported. But the contracts were not properly concluded, which led to a number of stumbling blocks. That said, the complete revision of the code must result in a standard mining agreement that incorporates all the related investments that mining companies must make, and which are negotiated outside the main agreement.

We’ve seen Perkoa finished, but what’s left in terms of investment, almost nothing.

The environment around Perkoa has not changed. Nor has life in Réo changed. There isn’t even a 3-star hotel where the mine is obliged to house its staff in order to develop the locality, and the mine’s head office hasn’t been built in Réo.

These are important elements. The Code could be reread to include binding notions that oblige mines to invest in the development of host localities.

Interview conducted by PB

#Mines_Actu_Burkina